| Target group | Numar maxim de participanti | Perioada de desfasurare |

|

|

|

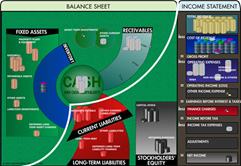

It is commonly called EBIT (earnings before interest and tax in the US). It is a very important number, so much so that it is called the Primary Result in Denmark (or Result Number 3 in Germany).

Who is Income|Outcome for?

Business Acumen for Any Industry

BUSINESS ACUMEN FOR EVERYONE

More about this simulation:

http://www.income-outcome.com/

About Andromeda Training Inc., the company that created this simulation:

http://www.income-outcome.com/about/

International companies that have used the Business Income / Outcome® Simulation

http://www.income-outcome.com/clients/

Accreditation is provided by Yissum Applied Management:

http://www.income-outcome.com/blog/bid/56385/Yissum-our-management-training-partner-in-Israel

OUR GOAL: SPEAKING THE SAME LANGUAGE

Our goal is to replicate a business environment as faithfully as possible in a simulation so that participants develop key business leadership skills.

The aim of the workshop is that, after finishing the workshop, the participants will be able to take, with greater certainty, decisions that do not endanger the future of the company's medium / long term.

REASONS FOR YOU TO PARTICIPATE

- focus on experiential learning;

- rules and specific language are explained in detail and at length - those financial statements that sometimes might have produced you some fears - are now experienced and understood step by step;

Income/Outcome course content supports development of key competencies, including:

- Accountability: There is no “chance” element in Income/Outcome simulations. All events are the direct result of decisions made and actions taken. Provides tools for reporting progress and results.

- Ability to form strong relationships: Clarifies the function of each department within the organization. Gives an appreciation for the needs of other employees in the company and the challenges they face.

- Business expertise: Provides working knowledge of business terms and definitions. Includes standard financial reports and common business metrics. Gives practical experience using financial planning and analysis tools.

- Customer focus: The competitive market reinforces the underlying importance of meeting customer needs. Includes quality, customer service, reputation, niche markets, as well as price and terms.

- Business decision making: Emphasizes the importance of cash flow, clarifies the need to manage separately for profit and cash. Provides the tools to track revenues and expenses, and for forecasting, planning, and execution of business strategy. Requires constant decision-making and action regarding the allocation of resources. Looks at how metrics impact behavior, and how new metrics can change results.

- Flexibility: Requires constant monitoring of competitors, and frequent adaptation of business plan in response to changing market conditions. Addresses problems from several points of view, reflecting diverse departmental views and the numerous financial aspects of running a business.

- Open communication: Clarifies the need for a common language and a shared understanding of business. Develops a standard business vocabulary with company specific elements. Provides a forum for the exchange of ideas in a cross-over context with interdepartmental concerns and priorities.

- Taking initiative: Demonstrates the need for constant improvement. Provides a risk-free environment in which to try out new ideas and approaches.

- Organizational skills: Creates a matrix for organizing business concepts, encourages the use of this matrix in prioritizing financial information. Provides a visual model for remembering all the factors that need to be considered in developing a plan or making a decision.

- Project planning skills: Provides a “big picture” understanding of the business. Provides working knowledge of planning tools such as forecasts and budgets (level-specific).

- Working with other team members: Demonstrates the need to work together to meet time deadlines and financial targets. Practice in shared decision-making in a risk-free environment. Provides a forum for the exchange of ideas. Team size is designed to maximize participation by team members.

- Focus on shareholder value: Presents the view of the shareholder. Experience investor risk and reward.

HOW DO WE WORK?

The teams in which they are active become companies operating in the same market.

The classroom itself becomes, meanwhile, an entire competitive market.

Participants will improve their managerial skills as they "play" with the various decisions and contexts in which the simulation will put them, plan, and gradually work in more and more complex activities where all kinds of challenging situations arise. Just like in real life.

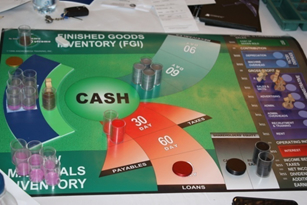

The balance sheet is presented in a well structured form, which precisely shapes its role in financial management: the presentation of all the resources a firm has and its financial sources.

- why we make a profit and still not have the necessary funds current activities?

- why we can't invest, although the market and the competition force us to do it?

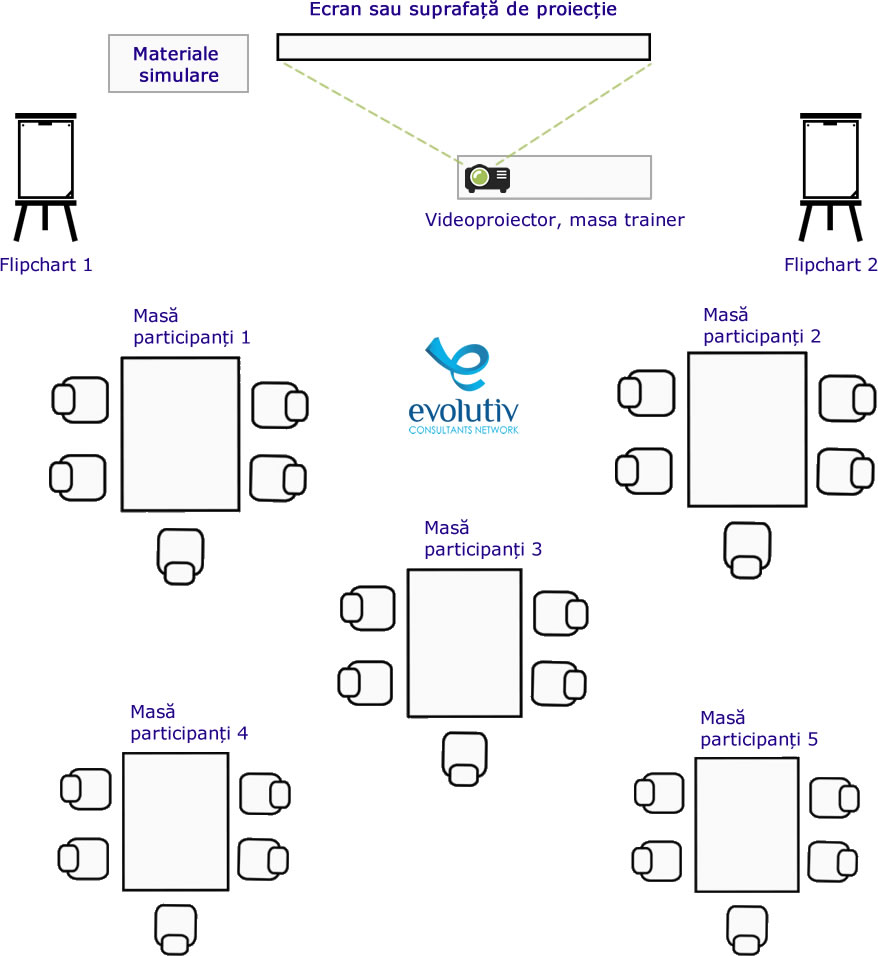

OPTIMUM classroom setup